Compliant Operation

Compliant Operation

The Company continuously improves its compliance management system, adhering to the principles of “Law-abiding Operations, Prudent Business Practices, and Integrity-driven Governance.” The Company has formulated a series of relevant regulations, including the Internal Control Management System, based on applicable laws and regulations. Through legal and regulatory training, the Company enhances employees’ compliance awareness to ensure that all business activities comply with laws, regulations, and internal standards, promoting the Company’s steady and sustainable development.

During the Reporting Period, the Company conducted a total of 2851 legal compliance training sessions, totaling 3518 hours, with 15532 participants.

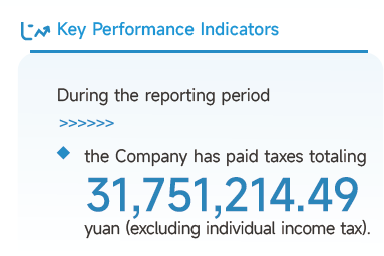

The Company consistently maintains a high level of compliance awareness and strictly follows national tax laws, taking lawful and honest tax payment as the core principle of its tax management. In practice, the Company, in strict accordance with tax collection and administration requirements, employs refined management techniques to complete various tax declarations and payments on time and accurately, ensuring the completeness and timeliness of tax payments, effectively preventing any form of tax evasion or avoidance and other tax violations.

Management of Connected Transactions

The Company fulfills the deliberation procedures and information disclosure obligations for connected transactions in strict accordance with the relevant provisions of the Articles of Association, the Rules of Procedure for General Meetings of Shareholders, the Rules of Procedure for the Board of Directors, the Related Party Transaction Management System and other systems. It strictly implements the system of avoidance of voting on connected transactions and gives full play to the role of independent directors in its actual work to safeguard the legitimate rights and interests of the Company and its shareholders.